Inside the AI Bubble: Why This One Might Be Different

This isn’t a dot-com rerun. It’s the industrialization of intelligence.

The question of whether artificial intelligence represents a sustainable transformation or a speculative bubble can’t be answered with opinion alone. It requires data — capital flows, infrastructure build-out, deployment patterns, and startup performance.

At E1 Ventures, our perspective starts with what can be measured and built. We invest in atoms, not bits: the tangible foundations of intelligence such as datacenters, chips, robotics, manufacturing, energy, and hardware systems. While software will always matter, enduring value lies in controlling the physical infrastructure that makes computation possible. The AI revolution isn’t just happening in models and code; it’s unfolding in steel, silicon, and power.

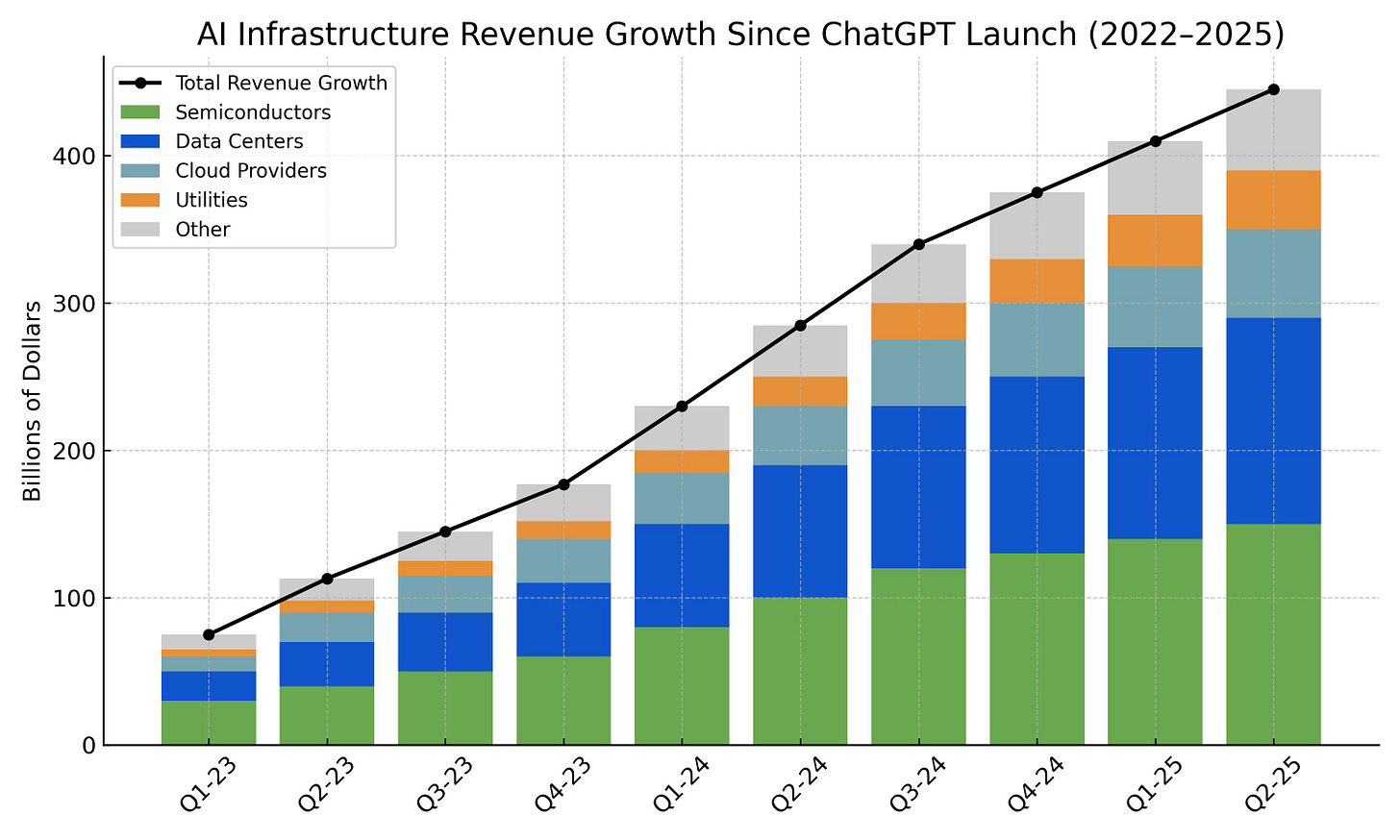

That reality is visible in the numbers. McKinsey estimates global AI-infrastructure investment will reach $7 trillion by 2030. The United States already accounts for about 76 percent of worldwide AI spend, with IDC forecasting more than 40 percent annual growth through the rest of the decade. Hyperscalers are effectively building a new layer of industrial infrastructure: Meta has pledged $600 billion in U.S. data-center investment, Google plans $75 billion in 2025 capex, Microsoft is spending over $30 billion each quarter, and Amazon expects $118 billion for AWS.

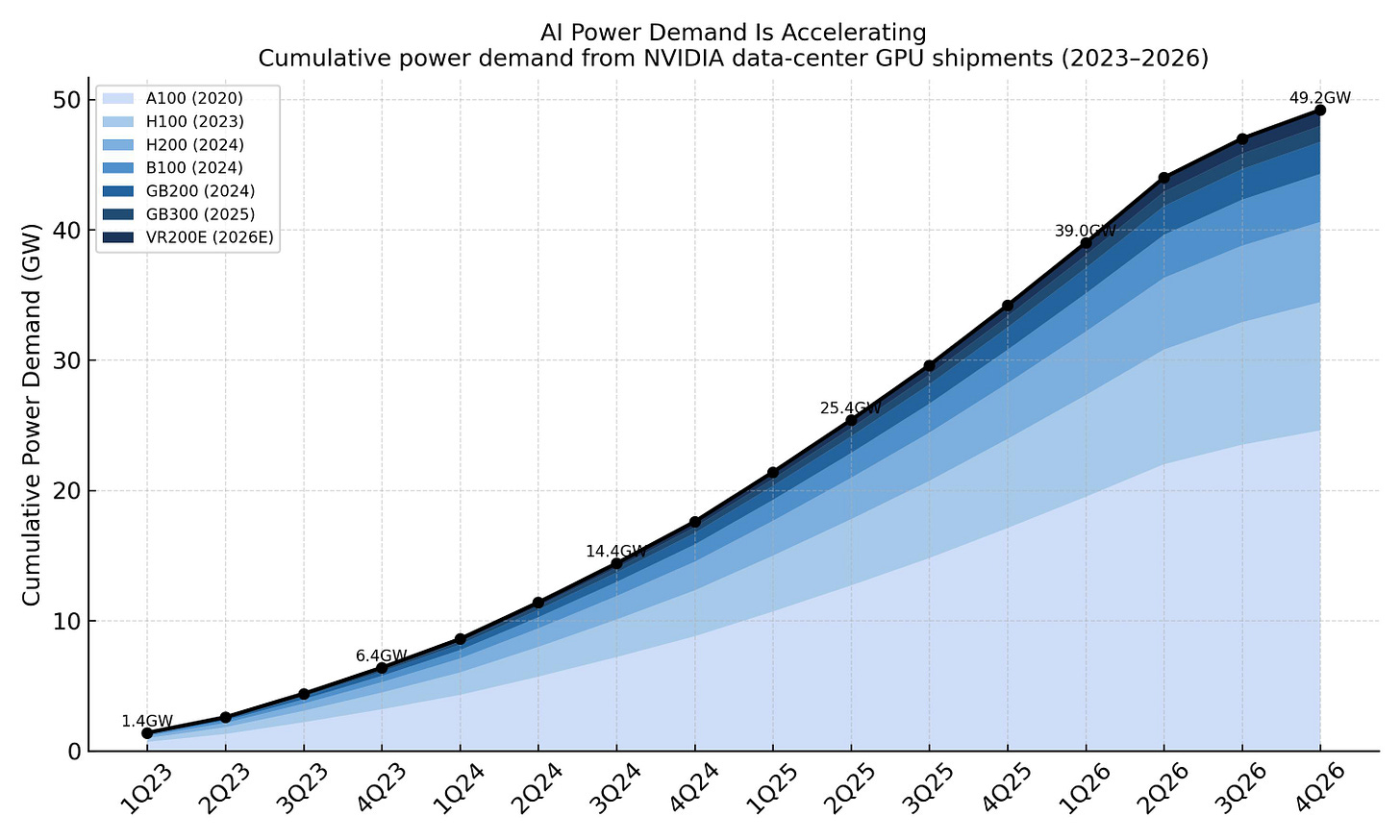

This surge in physical spending isn’t a side effect of the AI boom — it is the boom. Compute has become the most coveted resource of the digital age. Goldman Sachs projects data-center power demand will rise 160 percent by 2030, turning electricity and cooling into the new competitive constraints. In Virginia and Texas, utilities have begun rationing new capacity; tech giants now compete not for users but for megawatts. Innovation’s bottleneck is no longer human imagination but energy and supply chains.

Morgan Stanley takes a similar view but adds an important caveat: surging AI workloads could create a power shortfall of 13–44 gigawatts in U.S. data centers by 2028 — roughly a 20 percent gap. Analysts led by Stephen Byrd called AI computing “the most important technological shift in modern history,” noting that the real constraint may be electricity, not silicon. Their outlook, however, is far from pessimistic. They see the shortage as a trillion-dollar opportunity for grid modernization, small modular reactors, natural-gas turbines, and hybrid fuel-cell systems — technologies that could collectively add 40 GW of supply. Morgan Stanley also points to Bitcoin miners repurposing sites for AI computing, a shift that could recycle stranded assets and accelerate energy efficiency.

Like every industrial revolution before it, scarcity breeds bubbles. Steel, oil, railroads, and electricity all saw speculative booms before stabilizing into infrastructure. AI is tracing the same pattern: exuberant valuations on top of long-term capital formation.

Nowhere is that duality clearer than in venture markets. PitchBook reports more than 300 AI exits in 2025, with two-thirds of total U.S. venture deal value tied to the sector. Yet remove the handful of frontier labs — OpenAI, Anthropic, xAI, Databricks — and aggregate deployment falls by a quarter. The rest of the ecosystem is crowded with look-alike startups built on identical foundation models and rented compute. Most will vanish when capital tightens or GPU prices rise. What will endure are the physical assets beneath them: the servers, the chips, and the power infrastructure quietly compounding in value

The economics are already tilting toward those who own that layer. Goldman Sachs and McKinsey expect AI to add $2 – 4 trillion to U.S. GDP over the next decade, but the early gains accrue to semiconductor and cloud-infrastructure leaders. As in every industrial cycle, infrastructure owners profit first; users follow later.

Some observers call this a bubble, but bubbles aren’t defined by high prices — they’re defined by a mismatch between story and substance. The speculative froth sits mostly in the software layer: startups selling wrappers and interfaces around other people’s compute. When money is cheap, that looks like innovation. When costs rise, it evaporates. Meanwhile, the tangible infrastructure — chips, data-centers, energy systems — keeps generating cash.

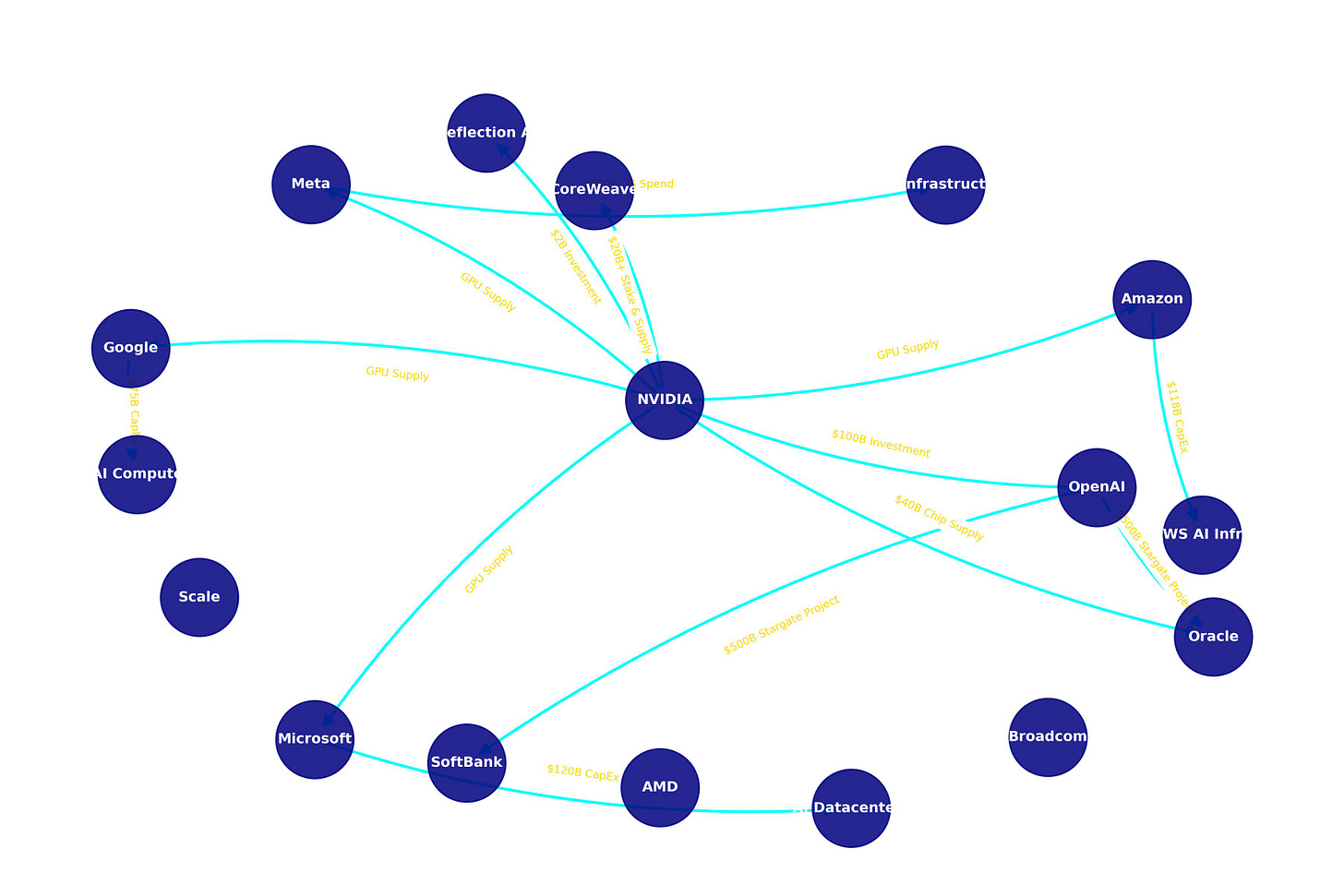

Take NVIDIA, the gravitational center of the AI economy. It provides nearly all advanced training hardware and has begun taking equity stakes in its customers. The company’s planned $100 billion investment in OpenAI ties directly to a long-term GPU supply contract, circulating the same capital twice: once as investment, once as revenue. NVIDIA also owns about seven percent of CoreWeave, which is expanding data-center capacity by $20 billion and securing GPU orders through 2032. And through its lead role in Reflection AI, an open-source U.S. model lab founded by ex-DeepMind researchers Misha Laskin and Ioannis Antonoglou, NVIDIA now influences both closed and open frontiers of AI research. Critics call it monopolistic; supporters call it strategy. Both are right.

The same industrial logic drives OpenAI’s “Stargate” project with Oracle and SoftBank — a network of five super-computing sites projected to cost $500 billion and draw 10 gigawatts of power. Oracle is financing it through bond offerings; NVIDIA will supply the chips. Stargate is capitalism’s moonshot, a half-trillion-dollar bet that whoever builds the most compute will own the future.

All of this is unfolding amid a broader geopolitical race. The U.S. and China are each growing AI infrastructure by more than 40 percent annually. Beijing’s state-backed funds are replicating their solar and EV playbook, while Washington pushes the CHIPS and Science Act and public-private partnerships. Compute has become a proxy for sovereignty. Even if private markets cool, governments will keep the engine running.

Public sentiment, however, remains skeptical. A Pew Research survey found that only 24 percent of Americans think AI will help them personally, while 62 percent doubt the government’s ability to manage it. Viral Senate clips about “machines taking over” fuel anxiety, and local moratoriums on data-center permits slow progress. The irony: the AI buildout is one of the largest sources of U.S. industrial job creation in decades. The technology that people fear is already rebuilding the physical economy.

Every bubble begins as a truth exaggerated. The truth is that AI is transformative; the exaggeration is that transformation will be instant. Much of the capital flooding in today will not yield short-term profit. But history shows that excess investment in infrastructure rarely goes to waste. The fiber-optic glut of the 1990s became the backbone of streaming and cloud computing. The overcapacity being built now in compute and energy will underpin the next fifty years of progress.

The massive capex being deployed into data centers, chips, and energy systems isn’t simply cost; it’s long-term value that will be depreciated, renewed, and upgraded over time. High fixed investment today allows operators to spread cost across years of revenue while refreshing technology in manageable cycles. When a data center reaches the end of its useful life, its physical shell, power infrastructure, and location often retain value — they’re repurposed for new compute generations, much like power plants or telecom towers.

At E1 Ventures, this is precisely why we invest in the physical side of intelligence — the hardware, energy, and manufacturing systems that expand capacity and drive down cost. “Atoms not bits” isn’t nostalgia; it’s realism. Software can’t scale faster than the hardware that powers it. The next compounding returns will come from companies that make computation faster, cheaper, and more abundant.

When the fever breaks — and it will — valuations will cool, but the infrastructure will keep running. Compute will become a utility, invisible yet indispensable. The true winners will be those who own the grids, fabs, and factories of intelligence. For them, the bubble won’t have burst; it will have built the future.

Views expressed in posts, including articles, podcasts, videos, and social media, are those of the individual E1 Ventures personnel quoted in them and do not necessarily reflect the views of E1 Ventures, LLC or its affiliates. The posts are not directed to any current or prospective investors. They do not constitute an offer to sell or a solicitation of an offer to buy any securities and may not be used or relied upon in evaluating the merits of any investment.

The material available here, as well as on any associated distribution platforms or public E1 Ventures social media accounts and sites, should not be interpreted as investment, legal, tax, or other professional advice. You should consult your own advisers regarding legal, business, tax, and related matters concerning any investment. Any projections, estimates, forecasts, targets, or opinions contained in these materials are subject to change without notice. They may differ or be contrary to opinions expressed by others. Any charts or data included in these materials are for informational purposes only and should not be used as the basis for any investment decision. Certain information contained here has been obtained from third-party sources. While such information is believed to be reliable, E1 Ventures has not independently verified it and makes no representation regarding its accuracy or suitability for any particular situation. Some posts may include third-party advertisements. E1 Ventures has not reviewed such advertisements and does not endorse any of the content contained in them. All posts speak only as of the date indicated.

Nothing contained on Substack or on associated content distribution platforms should be construed as an offer to purchase or sell any security or interest in any pooled investment vehicle sponsored, discussed, or mentioned by E1 Ventures personnel. Nothing here should be interpreted as an offer to provide investment advisory services. Any offer to invest in an E1 Ventures–managed vehicle will be made separately and only by means of the respective fund’s confidential offering documents. Those documents must be reviewed in their entirety and are made available only to individuals or entities that meet specific qualifications under federal securities laws. These investors, which include only qualified purchasers, are considered capable of evaluating the merits and risks of potential investments.

There can be no assurances that E1 Ventures’ investment objectives will be achieved or that its investment strategies will be successful. Any investment in a vehicle managed by E1 Ventures involves significant risk, including the possible loss of the entire amount invested. Any investments or portfolio companies described or referred to here are not representative of all investments made by E1 Ventures, and there can be no assurance that such investments will be profitable or that future investments will achieve comparable results. Past performance of E1 Ventures’ investments, pooled vehicles, or strategies is not necessarily indicative of future results. Some investments, including certain publicly traded assets, may not be listed if the issuer has not granted permission for public disclosure.

E1 Ventures may invest in various tokens or digital assets for its own account. In doing so, E1 Ventures acts in its own financial interest. It does not represent the interests of any other token holder and has no special role in managing or overseeing any such projects. E1 Ventures does not undertake to remain involved in any project beyond its position as an investor.

The VC industry desperately needs more investors who understand the physics of compute.

I’m still undecided if this is similar to the dotcom or not. That era had money spread all over the place in poor business models. The AI bubble is all concentrated into mainly 5 stocks.

I think it’s coming disaster but one that one be a pop but a downtrend amplifier when the markets cool off.